south dakota property tax records

Find South Dakota Property Records. They are maintained by.

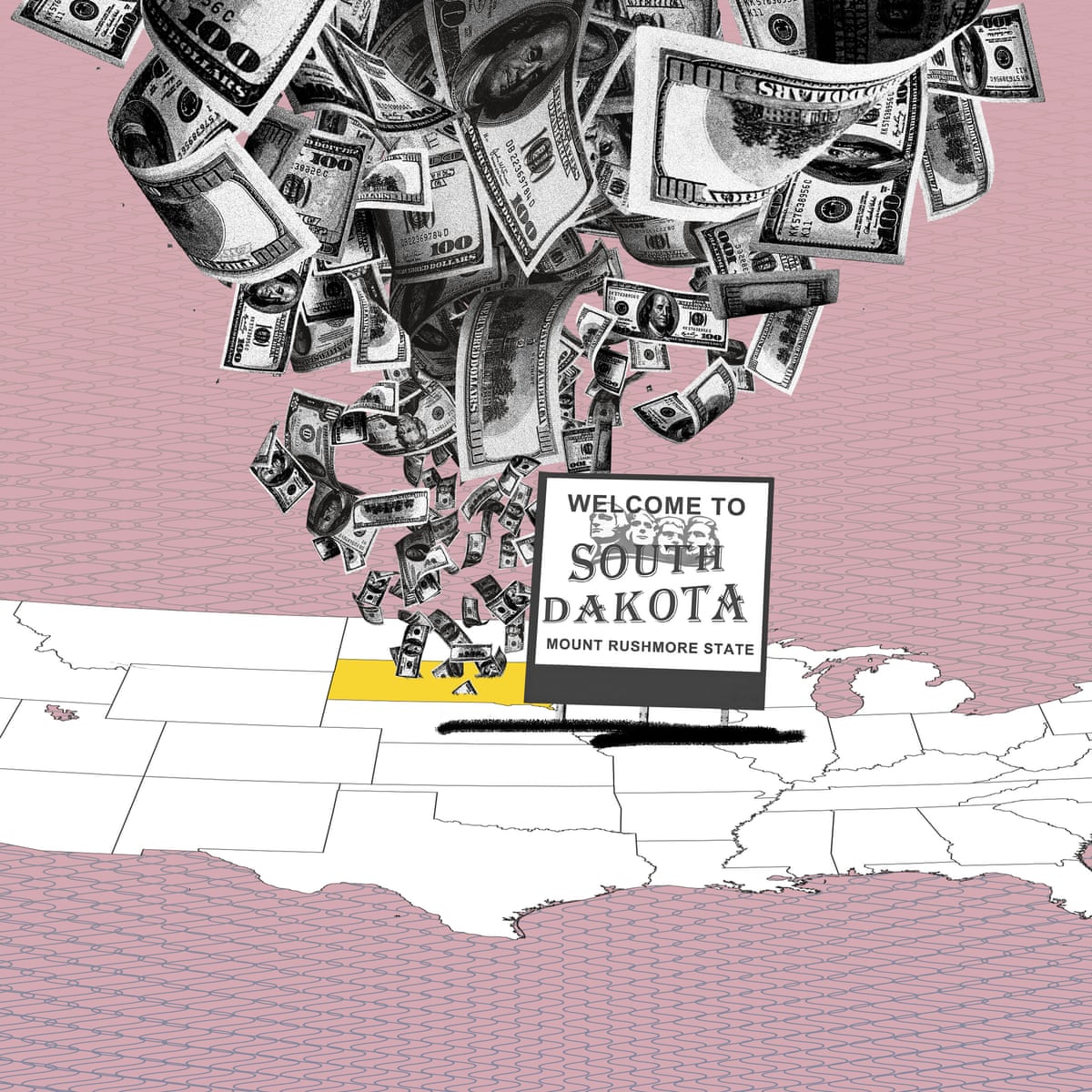

Here S How States Like South Dakota Have Become Global Tax Havens

Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent.

. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. This office is a storage facility for a host of local documents. Tax amount varies by county.

The Pennington County Equalization Department maintains an. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to. Convenience Fees will show as a separate charge on your statement.

Enter only your house number. If taxes are delinquent you will be unable to pay online. Spink County Government Redfield SD 57469.

Please contact the Treasurers Office for. The Pennington County Equalization Department maintains an. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. Public Property Records provide information on. Property assessments are public information.

Go to the Property Information Search. A new second tier of the tax would be set at 050 per every 1000 of a buildings value over 1 million and 050 per every 1000 of the lands value past 200000 Trevor J. Brookings County Equalization Office.

This is referred to as the. 128 of home value. 24 per Total Payment.

Real estate taxes are paid one year in arrears. Then the property is equalized to 85 for property tax purposes. Property assessments are public information.

The county register of deeds office can most appropriately be thought of as a library of local records. In maintaining ownership records the assessor defines the boundaries of land according to ownership and assigns a unique identifying number to each parcel. If you are a senior citizen or disabled citizen property tax relief applications are available through our.

ViewPay Property Taxes Online. Lincoln County has the highest property tax. Spink County Redfield South Dakota.

Search Brookings County property tax and assessment records by name address parcel ID and parcel map. The effective average property tax rate in South Dakota is 122 higher than the national average of 107. South Dakota Property Tax Records.

A South Dakota Property Records Search locates real estate documents related to property in SD. Any person may review the property assessment of any property in South Dakota. Any person may review the property assessment of any property in South Dakota.

You can look up current Property Tax Statements online. Look up statements online. Assessor Director of Equalization.

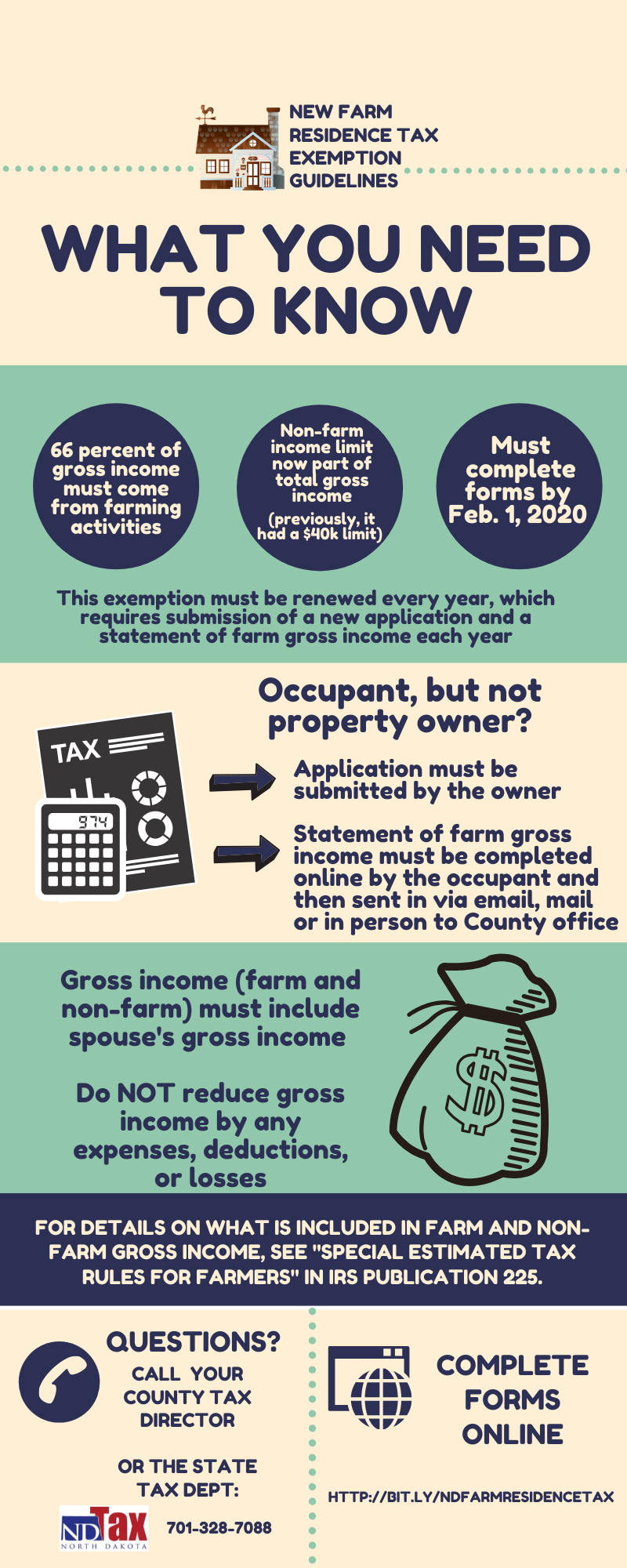

Welcome To The North Dakota Office Of State Tax Commissioner

Treasurer Fall River County South Dakota

About The North Dakota Office Of State Tax Commissioner

South Dakota Assessor And Property Tax Records Search Directory

Property Tax Calculator Smartasset

![]()

Assessor S Office Williams County Nd

Best Worst State Property Tax Codes Tax Foundation

North Dakota Property Tax Calculator Smartasset

Equalization Gregory County South Dakota

Assessor Hand County South Dakota

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

A Breakdown Of 2022 Property Tax By State

2022 Property Taxes By State Report Propertyshark